It is virtually impossible to get your business off the ground without being able to process credit cards, not to mention without developing your online presence. That means choosing a merchant account is one of the most important things to think about when you’re starting out. It shouldn’t be something you rush through, either. Researching your options for a merchant account provider should be a thorough process. So what do you look for? Nowadays, it’s much easier to stick with merchant account providers themselves rather than get a merchant account at a bank. Many of these companies will treat you more fairly and charge you lower fees than a big bank will, plus they are experts in the realm of online business and can keep up with advances in technology. It’s all a matter of finding one that’s right for you and can provide these basics.

1. A Good Reputation

You should check the Better Business Bureau before you commit to a merchant account provider to see how many complaints they have against them. Not only does this give you a good idea of the quality of their business, it also lets you know if they’re legit. The huge world of small business on the internet means scams are definitely out there. It’s also helpful to read reviews and testimonials from merchant account holders to get an idea of how much customer service they can provide you.

2. Relatively Low Fees

You will typically pay a 1 to 2 percent discount rate on every transaction, and you shouldn’t go with a merchant account provider trying to charge you more than that unless you have very bad personal credit when you’re applying. It’s normal for merchant account providers to charge setup fees, ACH fees, and fees associated with Address Verification Systems and internet transactions. If the fees at sign-up seem deceptively low, make sure you read the fine print, because you could be saddled with a large amount of unnecessary hidden fees later on.

3. The Ability to Meet Your Personal Needs

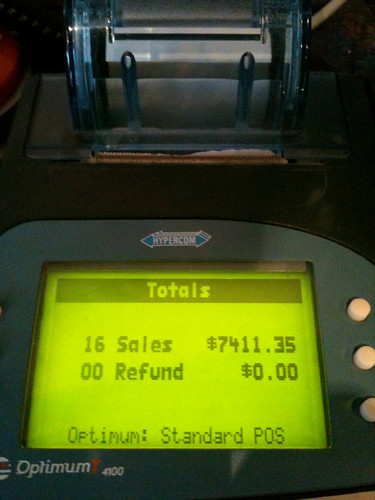

Not every business is the same, and so not every business needs the same things from a merchant account. You should look at how many different kinds of credit cards your account will accept and whether it is possible to process transactions from outside the United States. Are you conducting transactions in person or over the phone as well as online? You should look into your merchant account provider’s policies on equipment. Some sell, rent, or give away credit card terminals. It’s important to know how many machines will work for the size of your operation.

4. Customer and Technical Support

This could be the most important thing about your merchant account. When you’re a potential applicant, you will probably get a feel for how accessible the company representatives are. If they don’t answer your questions in a clear and open way right off the bat, they will probably not provide you with good service later. You want the security of knowing you can call and they will help you, especially if you’re new to merchant accounts and you get overwhelmed by the software.

A merchant account provider should have clear procedures and transparent fees, and you should feel like your business is in good hands with them. When you’re traversing the world of internet sales and the future of your business is at stake, it’s important to have people you can trust on your side. There’s nothing wrong with taking your time to find out who those people are.

– Author Tony Alvarez writes for Merchant Maverick, where you can find pos software comparison charts, as well as pos software reviews for companies such as 3dCart.